Skills in finance are crucial across a wide range of sectors, such as accounting, banking, investment, and business management. CIMA offers a comprehensive set of vital finance skills essential for all financial professionals. These essential skills include budgeting, financial analysis, problem-solving, risk assessment, and financial planning, among others. Mastering these skills ultimately leads to improved financial decision-making and a deeper understanding of the economic environment. Studying CIMA will provide you with a solid grounding in business and finance skills, management accounting, and business principles. As you advance in your qualifications, you will cultivate robust strategic abilities and knowledge, preparing you for leadership positions within your company. In today’s competitive job market, mastering financial skills is crucial for career advancement and success.

Considering a career in finance, it’s crucial to understand that employers highly value finance skills, which can lead to career advancement and increased earning opportunities. Through the right training and development provided by Accountants for Tomorrow, individuals can develop and refine their finance skills, proving to be an asset of value in both personal and professional capacities.

What do finance skills entail?

Finance jobs require a wide range of both hard and soft skills that can be utilized across various roles within the finance industry, such as finance managers, financial analysts, underwriters, chief financial officers, and accountants.

Different finance skills are necessary for each position and level of seniority; however, all finance professionals must possess several fundamental skills. These core skills will be further discussed below, as they enable professionals to maintain financial practices and assist a business in sustaining a strong financial position when used in conjunction.

In addition, these abilities enable experts to manage unforeseeable financial scenarios and address financial challenges in a way that benefits the organization they work for. Typically, these skills are acquired through formal education and professional experience.

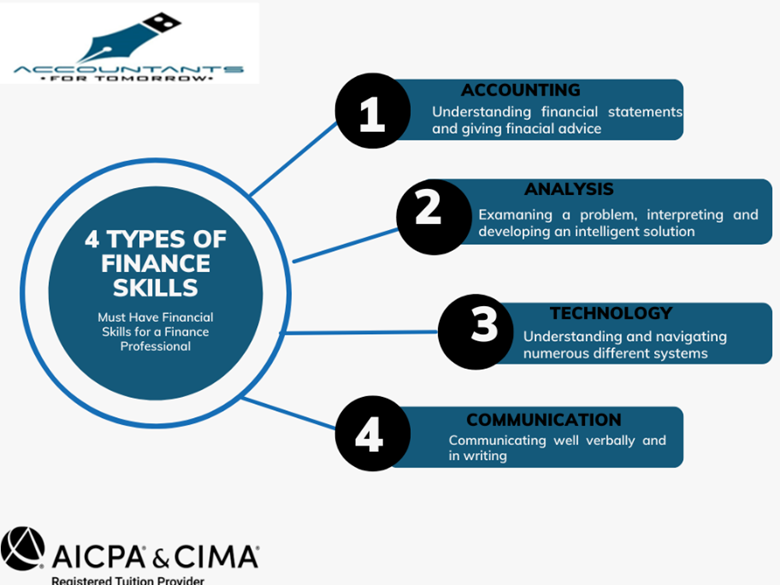

Finance skills can be categorized into four distinct groups, each focusing on a different aspect of finance jobs, and all are necessary for nearly every finance role.

- Accounting

Accounting involves the management of financial transactions (CIMA P1 Management Accounting) and the ethical handling of financial data and reports. Gaining accounting skills usually requires a formal financial education focused on accounting principles, mathematics, and data analysis. Given the heavy regulations in the field, accounting skills must also encompass an understanding of and compliance with current regulations. Depending on the finance role, individuals may or may not be responsible for preparing financial statements and managing budgets. However, all finance professionals must be able to interpret and discuss financial statements and, in some cases, provide financial advice. Potential finance skills linked to accounting comprise implementing accounting principles, standards, and techniques, understanding budget creation and cash flow management, managing financial data, reconciling financial statements and transactions, as well as conducting cost analysis and engaging in cost reduction activities. Examples of finance roles that require these skills include financial analysts, accountants, and finance managers.

2. Analysis

The skills required for finance positions extend beyond mere numerical analysis, as seen in CIMA Advanced Management Accounting. Employers anticipate finance professionals to interpret financial data and transform it into valuable insights for the business. Therefore, analyzing financial information constitutes the second crucial set of finance skills.

The skills related to financial analysis encompass the following abilities:

• Review financial data.

• Utilize data to achieve business objectives.

• Interpret data to guide financial decision-making.

At a practical level, analytical finance skills involve the capacity to conduct comprehensive data analysis and effectively utilize technology for this purpose. This enables professionals to address financial challenges.

Potential finance skills linked to analysis include:

• Analyzing data and making informed financial decisions.

• Conducting financial analysis and planning.

• Making forecasts and projections based on business and financial data.

• Gaining a broader understanding of how a business operates and integrating this knowledge into financial planning.

• General problem-solving abilities.

- Communicate findings effectively; for example, effective communication of findings is crucial for influencing financial decision-making.

3. Technology

With the abundance of finance technology tools available today, a vital finance skill is the capability to leverage this technology to gather, comprehend, and derive insights from financial data. In today’s digital age, leveraging technology is essential for uncovering insights from financial data.

In the realm of finance, technology can offer nearly limitless assistance. Financial technology acquired in ‘CIMA Managing Finance in a Digital World’ aids finance professionals in uncovering, organizing, and processing vast volumes of information, thereby replacing what was once labor-intensive and routine tasks.

Due to the constant evolution and changes in financial technology, finance professionals require strong technological skills to stay abreast with the latest industry advancements.

Potential finance skills associated with the technology category include:

• Possessing financial engineering and modeling skills.

• Utilizing accounting software such as Xero and QuickBooks.

• Applying all facets of financial transaction recording and analysis.

• Employing financial technology to solve problems and deliver business outcomes.

4. Communication

Working in the financial sector demands a high level of trust, and as many stakeholders are involved, effective communication is a crucial skill for finance professionals.

There are several components to trustworthy and effective communication in finance:

- Articulating ideas without using complex jargon.

- Simplifying intricate concepts for better understanding.

- Maintaining integrity in communication.

Key finance skills related to communication include:

- Clearly and effectively conveying financial advice and reports.

- Grasping verbal and non-verbal communication methods.

- Fostering trust and confidence through motivation.

- Effectively managing relationships with diverse stakeholders.

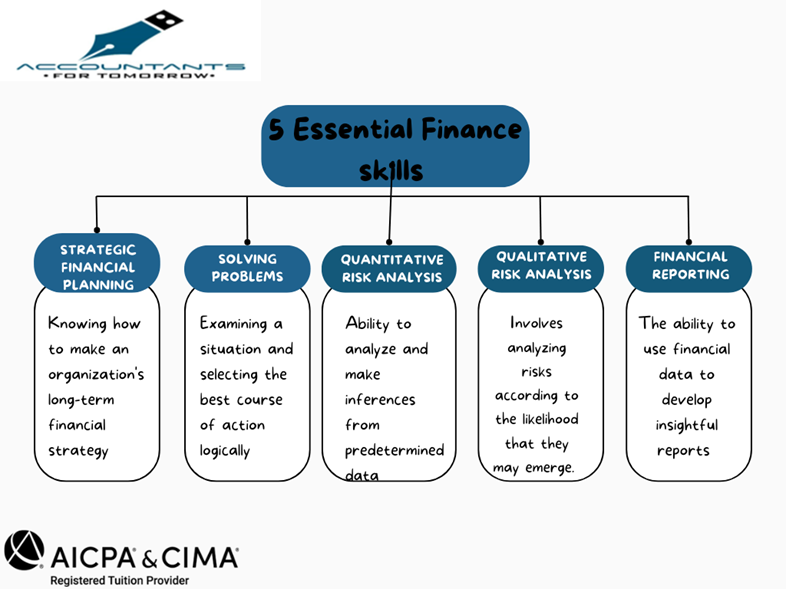

5 essential finance skills with examples

These five finance skills are essential for almost all finance professionals and are pivotal in addressing financial issues within a business and interpreting financial data for the organization’s benefit.

Below are the crucial finance skills, along with a practical example for each skill and a brief guide on enhancing them:

- The ability to think analytically involves gathering and analyzing financial data to make decisions based on the findings.

Your knowledge of advanced financial reporting from your CIMA studies will help you to think critically. Ethical handling of financial data is paramount, as unethical practices can lead to severe consequences for both individuals and organizations, including legal repercussions and loss of trust.

Analytical skills encompass detecting patterns, observing and interpreting data, integrating information, and making decisions.

For instance, an instance of analytical thinking in finance would be running various financial reports to identify previously unnoticed costs.

Improving analytical thinking skills can be achieved by analyzing simulated data sets and attempting to come up with new conclusions.

2. Problem-solving entails identifying a problem, generating potential solutions, evaluating these options, choosing a solution, and implementing it.

Gaining knowledge of financial strategy through CIMA coursework allows you to implement problem-solving skills.

It involves comprehending the challenges a business may face and using creativity and resourcefulness to devise solutions.

For example, demonstrating problem-solving skills in finance would involve understanding the reasons behind a business’s persistent losses despite having sound finances.

Enhancing problem-solving abilities often involves practicing unconventional and innovative solutions. Continuous learning is vital in finance due to evolving regulations and technologies. This commitment to ongoing education ensures that professionals remain competitive and well-equipped to navigate the complexities of the financial landscape.

3. Strategic financial planning involves making decisions about managing a business’s finances to achieve both long- and short-term financial goals.

By studying CIMA, you gain the ability to apply strategic financial planning through the knowledge of strategic management. A way to enhance strategic financial planning is to create forecasts for profits and losses for the upcoming year and analyze methods to enhance core financial metrics.

To improve strategic financial planning skills, aim for shorter planning cycles to work with the most current data available.

4.Quantitative risk analysis is a technique that uses numerical estimates to evaluate the potential impact of a specific risk on an objective.

Studying CIMA equips you with Risk management, which enables you to apply both quantitative and qualitative risk analysis

Financial professionals use quantitative risk analysis to estimate future insurance premiums based on the likelihood of certain events occurring.

To enhance quantitative risk analysis skills, regularly review the risk analysis process in depth.

5. Qualitative risk analysis involves clearly defining a risk in writing, evaluating its potential impact, and detailing strategies to mitigate it. Financial professionals use qualitative risk analysis to assess a company’s value based on unquantifiable assets such as leadership or culture strength.

To enhance skills in this area, strive to gain a deeper understanding of the probability and impact of potential risks facing your business.

Effective communication with stakeholders is essential in risk assessment to ensure all perspectives are considered.

Conclusion

CIMA will strengthen your foundation in management accounting, business principles, and finance skills, fostering the development of robust strategic abilities and knowledge that position you for leadership roles within your organization. To further enhance your financial skills, consider pursuing additional education or training opportunities that align with your career goals.

In summary, developing essential finance skills is crucial for success in today’s dynamic financial landscape. Whether you are just starting your career or looking to advance in your current role, honing these skills will not only enhance your professional capabilities but also position you as a valuable asset to your organization.

We encourage you to take proactive steps in your professional development. Assess your current financial skills and identify areas for improvement. You might want to think about signing up for pertinent courses, like the ones provided by CIMA, to enhance your understanding and skill set. Additionally, seek mentorship opportunities to gain insights from experienced professionals in the field.

To read more, visit our website blog post area: www.accountantsfortomorrow.co.za/blog